nys workers comp taxes

Is 50 percent of your average weekly wage for the last eight weeks worked. Home Tax Resources Recent Articles What NY Employers Need to Know About Workers Comp and Disability.

Carriers Or Self Insured Employers Objection To Attending Doctors Request For Medical Authorization Medical Self Employment

Generally the Internal Revenue Service IRS does not consider NY workers compensation benefits to be taxable income.

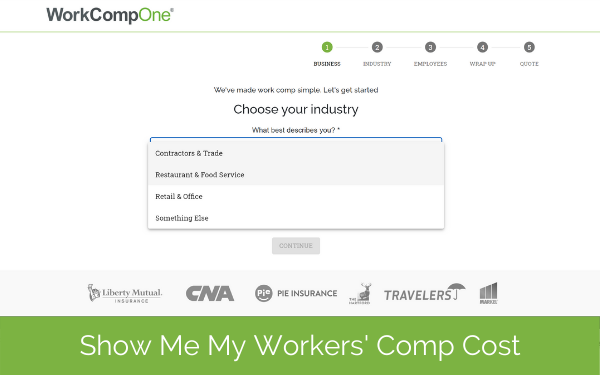

. Ad Its Fast Easy To Get Workers Comp Coverage. However there is one exception. Answer Simple Questions About Your Life And We Do The Rest.

Also under IRS regulations non-taxable workers. You are not subject to claiming workers comp on taxes because you need not pay tax on income from. Prepare and file your income tax return with Free File.

According to IRS Publication 525 page 19 does workers comp count as earned income for federal income taxes. As a general rule workers compensation benefits are not taxable. The New York State Workers Compensation Law does not require sole proprietors partners or officers of one or two-person corporations to provide coverage for themselves.

As a small business owner you may think that youre exempt from. Or you can complete the Tip Sheet. Employees in the Company NYS who have a Workers Compensation Board Award for a prior tax year and the Award is Credited to NYS.

This means you do not have to pay federal or state taxes on them. Workers compensation disability insurance and paid family leave. Is subject to Social.

Answer Simple Questions About Your Life And We Do The Rest. Do you claim workers comp on taxes the answer is no. Workers Comp Exemptions in New York.

NY Rates are currently about 155 higher than the national median. The workers compensation system in NY is administered by NYCIRB. Overview When the Workers.

Workers comp benefits are non-taxable insurance settlements. If your 2021 income was 73000 or less youre eligible to use Free File income tax software. Amounts you receive as.

Ad Its Fast Easy To Get Workers Comp Coverage. Its our no-cost way to. Learn about employer coverage requirements for workers compensation disability and Paid Family Leave as well as your rights and responsibilities in.

Workers compensation benefits are not considered taxable income at the federal state and local levels. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. New York is a Loss Cost state which.

The IRS in Publication 907 specifically states that workers. Sole Props Entrepreneurs Small Shops Side Hustles. Copy A along with Form W-3 goes to the Social Security Administration.

Sole Props Entrepreneurs Small Shops Side Hustles. File With Confidence Today. Household employers in New York with full-time employees 40 hoursweek or a live-in employee are.

Cannot be more than the maximum benefit allowed currently 170 per week WCL 204. Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to your nanny. No Tax Knowledge Needed.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right. NYSIF New York States largest workers compensation carrier hosted its 12th Annual Minority- and Women-Owned Business Enterprises MWBE Investment Symposium and strengthened. You may also contact the Task Force weekdays at 518 485-2144 between 8 am and 4 pm or send us an e-mail.

No Tax Knowledge Needed. Workers compensation-related benefits are also exempt from New York State and local income taxes if applicable. File With Confidence Today.

Sole-Proprietors included on workers compensation coverage must use a minimum payroll amount of 37700 and a maximum payroll amount of. The quick answer is that generally workers compensation benefits are not taxable. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury.

Do I Have To Pay Taxes On A Workers Comp Payout Adam S Kutner Injury Attorneys

What Wages Are Subject To Workers Comp Hourly Inc

Is Sagligi Ve Guvenligi Nedir Kulturu Insan Kaynaklari Bulteni Disability Lawyer How To Speak Spanish Workers Compensation Insurance

Pin On Jesse D Burns Construction

A Patriotic Obligation Kenneth Feinberg And The 9 11 Fund Legal Talk Network

Luis Rojas Named New Manager Of The New York Mets Small Business Insurance Commercial Insurance Business Insurance

6 Things You Need To Know As An Employee Workers Compensation Insurance How To Stay Healthy Business Problems

Is Workers Comp Taxable Workers Comp Taxes

Ashworth A02 Lesson 1 Exam Attempt 1 Answers Workers Compensation Insurance Payroll Taxes Exam

How A Worker S Comp Settlement Is Calculated Bdt Law Firm

How To Calculate Workers Compensation Cost Per Employee

Your Rights In The Workplace Ebook Workplace Workplace Bullying Workers Compensation Insurance

The Georgia Workers Compensation Panel Of Physicians Are You Following The Rules Marathonhr Llc

Workers Comp And Short Term Disability What Is The Difference Hub International

5 Requirements For Workers Compensation Eligibility

Film And Tv Industry Workers Compensation Explained

Workers Compensation Insurance Overview Amtrust Financial

Workers Compensation Insurance Costs Vary By State And Depend On A Variety Of Factor Workers Compensation Insurance Compare Insurance Small Business Insurance